montgomery county maryland earned income tax credit

Montgomery County Education Association unit members should pay particular attention to t he special deadlines that impact your unused earned sick leave payout. Regardless of your income if you adopt a child with special needs you may receive monthly adoption assistance payments andor medical assistance for the child.

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

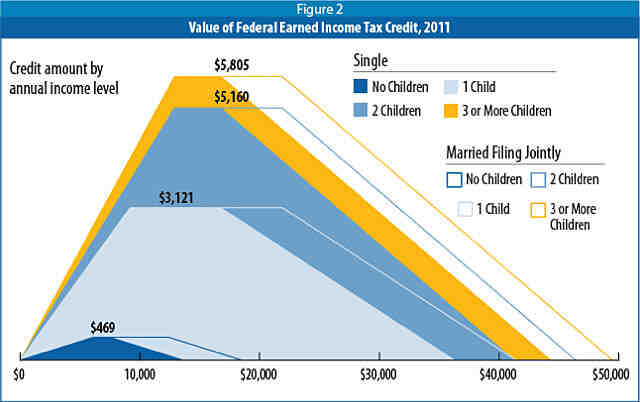

The maximum federal EITC is 6728.

. For a person or couple to claim one or. Low income adults with no children are eligible. Earned Income Tax Credit.

One months retirement income and in some cases a delay of future cost-of-living adjustments. If you earned less than 58000 in 2021 you may qualify for the federal Maryland and Montgomery Earned Income Tax Credit. The Maryland Child Support Administration CSA works with both parents to provide the financial medical and emotional support their children need to grow and thrive.

The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. If you file with an ITIN you may qualify for the Maryland EITC and in Montgomery County for the Working Families Income Supplement.

In Montgomery County and Washington County for tax years 2007 and later the position can be a contract position of definite duration lasting at least 12 months with an unlimited renewal option. Expanded the Countys Earned Income Tax Credit by nearly 25 making Montgomery County one of the few local governments in the country with such an expansive anti-poverty program. The creation of the Night-time Economy Task Force resulting in numerous pieces of legislation passed by the Maryland state legislature and the County.

The African-American middle class consists of African-Americans who have middle-class status within the American class structureIt is a societal level within the African-American community that primarily began to develop in the early 1960s when the ongoing Civil Rights Movement led to the outlawing of de jure racial segregationThe African American middle class exists. These arrangements are made when the child is placed with you and will continue after the adoption is finalized. The amount of EITC benefit depends on a recipients income and number of children.

Maryland Solar Incentives Md Solar Tax Credit Sunrun

Pricing D Alessandro Associates Group Llc

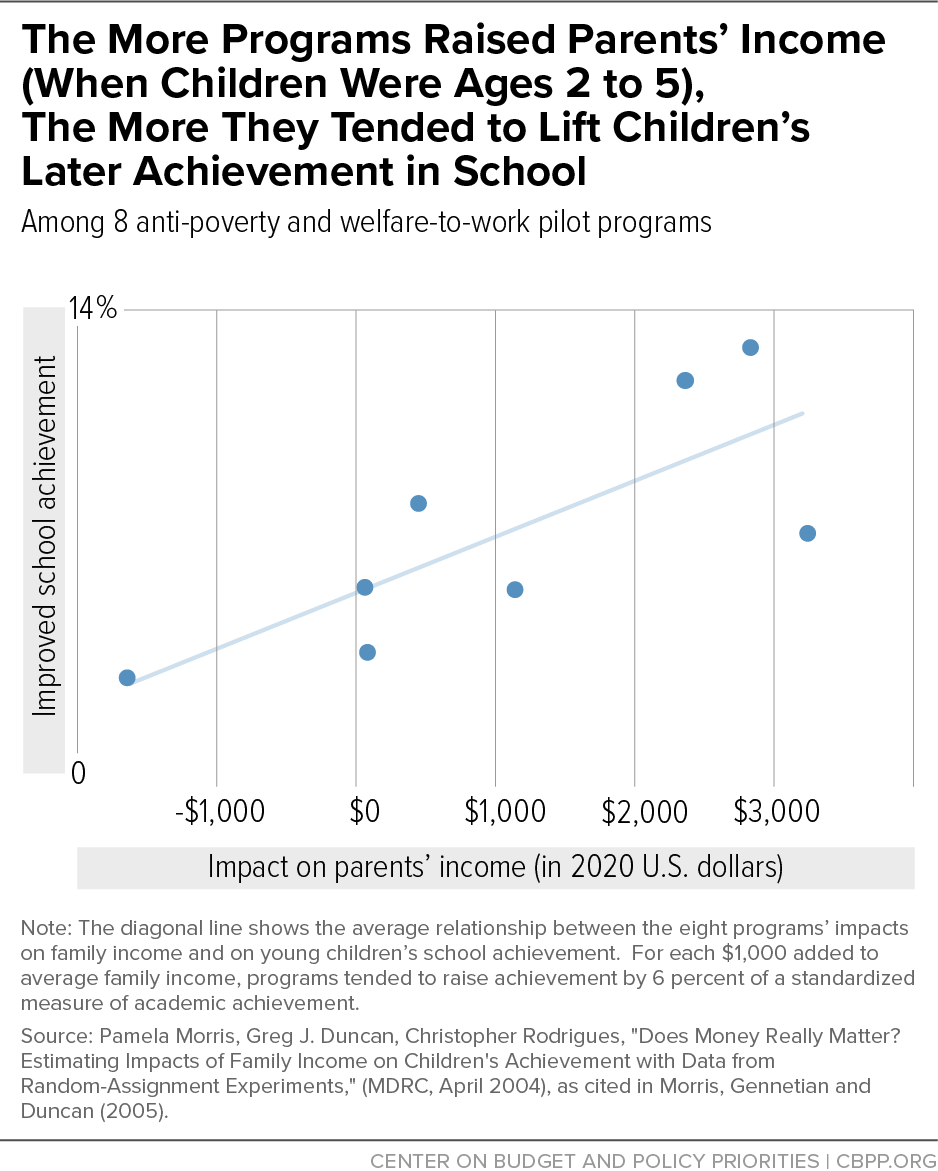

Recovery Proposals Adopt Proven Approaches To Reducing Poverty Increasing Social Mobility Center On Budget And Policy Priorities

Recovery Proposals Adopt Proven Approaches To Reducing Poverty Increasing Social Mobility Center On Budget And Policy Priorities

Baltimore City Maryland Department Of Human Services

Montgomery County To Provide Free Virtual Tax Preparation Appointments The Moco Show

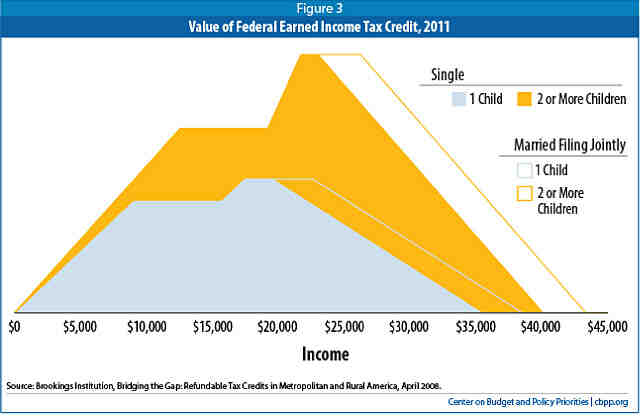

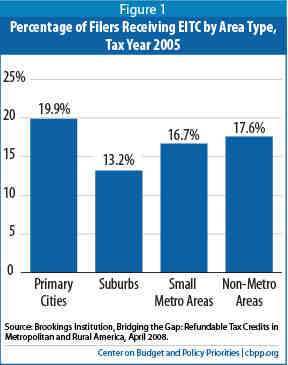

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

A Hand Up How State Earned Income Tax Credits Help Working Families Escape Poverty In 2011 Center On Budget And Policy Priorities

Black Economic Alliance Welcomes Five New Members To The Advisory Board Black Economic Alliance Foundation

Julie Palakovich Carr Facebook

Free Tax Prep For Low To Moderate Income Marylanders Wtop News