trust capital gains tax rate 2020

2021 capital gains tax calculator. For tax year 2020 the 20 maximum capital gain rate applies to estates and trusts with income above 13150.

Biden Tax Plan Estate Trust Planning Election 2020 New Guide

Solved 3 days ago Jun 30 2022 Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and.

. The 2020 estimated tax. 20 for trustees or for personal representatives of someone who. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year.

For tax year 2022. For 2020 trusts pay tax at the maximum income tax. For tax year 2020 the 20 rate applies.

The maximum tax rate for long-term capital gains and qualified dividends is 20. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. What Is The Capital Gains Tax Rate For Irrevocable Trusts.

What is the capital gains tax rate for trusts in 2020. The following Capital Gains Tax rates apply. Find out more about Capital Gains Tax and trusts.

The tax rate on most net capital gain is no higher than 15 for most individuals. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income. The 0 and 15 rates continue to apply to certain threshold.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Capital Gain Tax Rates. For example the top ordinary Federal income tax rate is 37 while the top.

Trust tax rates are very high as you can see here. What is the capital gains tax rate for trusts in 2022. 2022 capital gains tax rates.

The maximum tax rate for long-term capital gains and qualified dividends is 20. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. For tax year 2021 the 20 maximum capital gain rate applies to estates and trusts with income above 13250.

2019 to 2020 2018 to 2019 2017 to 2018. 2022 Long-Term Capital Gains Trust Tax Rates. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits.

Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. It applies to income of 13450 or more for deaths that occur in 2022. This helpsheet explains how United Kingdom UK resident trusts are treated for Capital Gains Tax CGT.

Capital gains and qualified dividends. For tax year 2020 the 20 rate applies to amounts above 13150. Fiduciary tax brackets are compressed.

However long term capital gain generated by a trust still. The highest trust and estate tax rate is 37. With a few days remaining in 2020 a trustee can still employ tax-saving strategies.

It continues to be important. The 0 rate applies up to 2650. HS294 Trusts and Capital Gains Tax 2020 Updated 6 April 2022.

Some or all net capital gain may be taxed at 0 if your taxable income is. The tax-free allowance for trusts is. The tax rate works out to be 3146 plus 37 of income.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Table of Current Income Tax Rates for Estates and Trusts 202 1 Irrevocable trusts have a major tax issue. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

It also deals with. The 15 rate applies to.

What Are Capital Gains Taxes And How Could They Be Reformed

2022 2023 Tax Brackets Standard Deduction 0 Capital Gains Etc

Resources Hawaiʻi Tax Fairness Coalition

Interest Rates At Historic Lows Wealth Transfer Opportunities At Historic Highs Hundman Wealth Planning

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Solved Can You Avoid Capital Gains Taxes On A Second Home

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Connecticut State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

The Tax Impact Of The Long Term Capital Gains Bump Zone

2020 2021 Capital Gains And Dividend Tax Rates Wsj

9 Ways To Reduce Your Taxable Income Fidelity Charitable

2021 Trust Tax Rates And Exemptions

The Generation Skipping Transfer Tax A Quick Guide

What You Need To Know About Capital Gains Tax

Florida Real Estate Taxes What You Need To Know

What You Need To Know About Capital Gains Tax

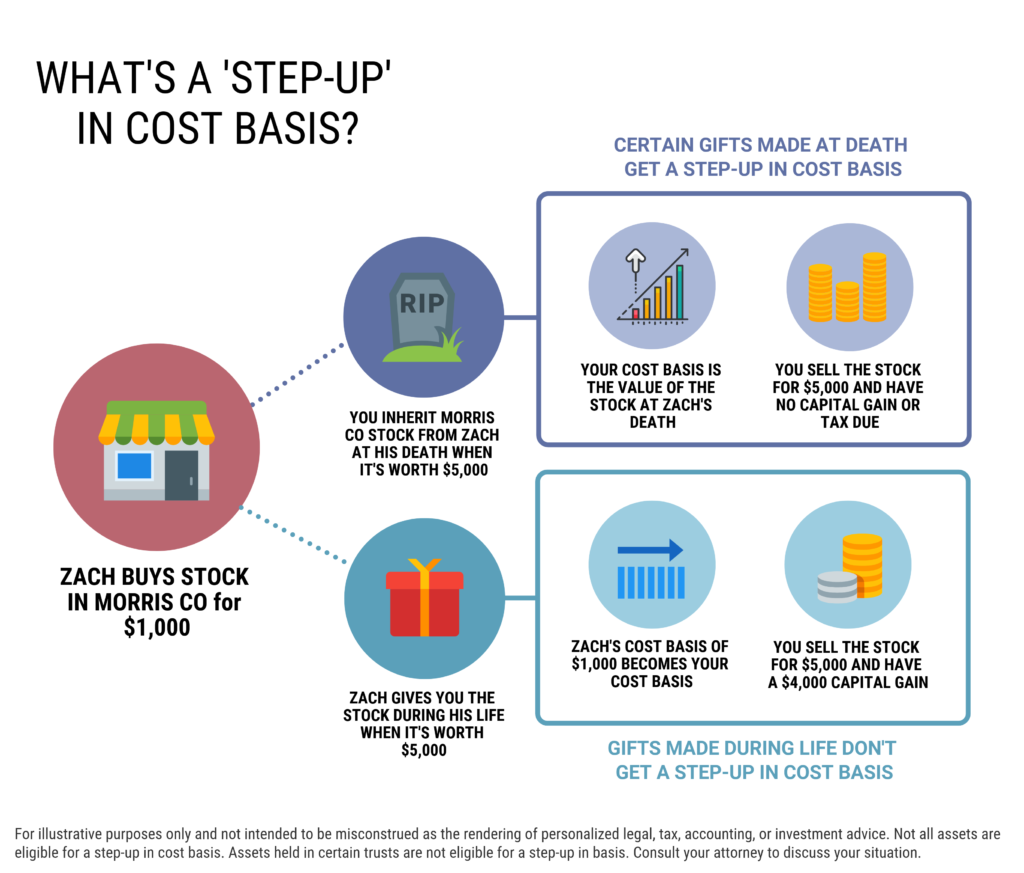

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Trump S Rumored Tax Cuts 2 0 Proposals Aren T Focused On The Middle Class Center For American Progress